1. Introduction of Bank Owned Life Insurance Policies

Brief Definition of Bank-Owned Life Insurance (BOLI)

Bank-Owned Life Insurance (BOLI) is a specialized life insurance policy purchased and owned by a financial institution on the lives of key employees. While the bank pays the policy premiums, it also serves as the primary beneficiary, meaning the death benefit is typically received tax-free if the policy is held until the insured’s passing.

Overview of Its Growing Importance for Banks and Credit Unions

Over the past decade, BOLI has gained momentum as an attractive asset class because the yields on these policies often exceed the after-tax returns available through traditional bank-eligible investments, such as Treasuries or municipal bonds. Beyond the potential for higher returns, many institutions leverage BOLI to offset rising employee benefit costs—like healthcare or retirement plans—and to diversify their investment portfolios. By doing so, they not only aim to enhance their non-interest income but also secure an asset that performs reliably over the long term.

To learn more about our full range of offerings, visit our Services page.

Why CFOs, CEOs, and Board Members Should Care

From a leadership perspective, BOLI presents multiple strategic advantages:

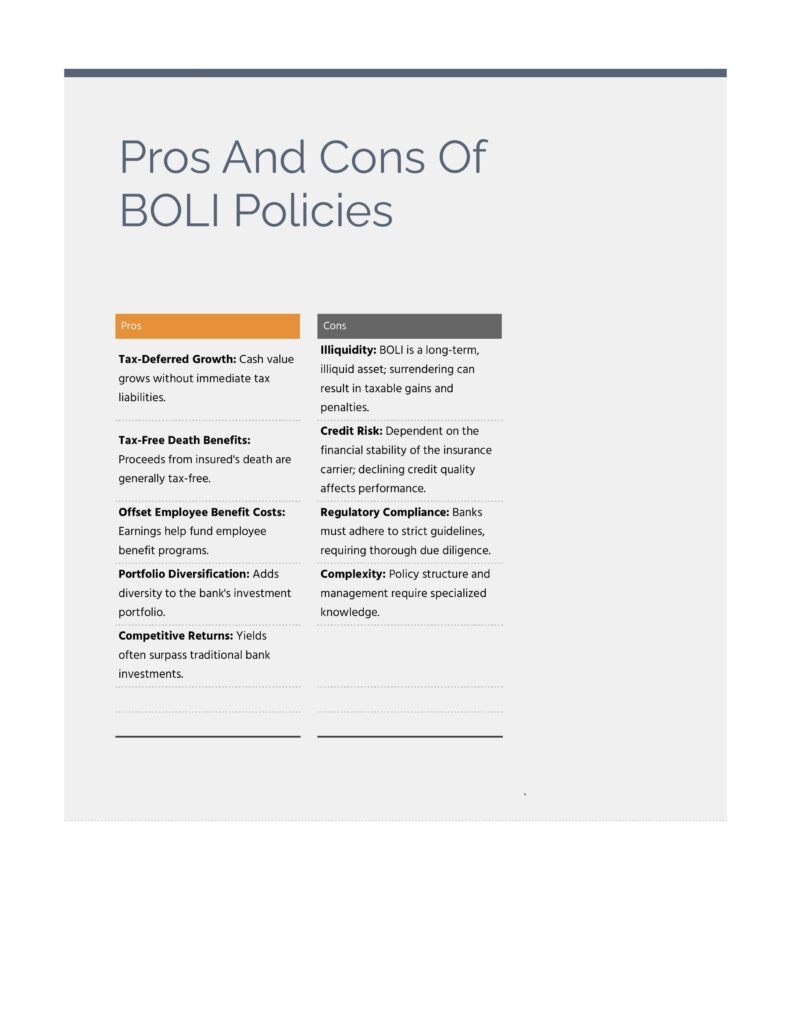

- Tax Benefits: Growth in a BOLI policy’s cash value is tax-deferred, and the death proceeds can be free from federal income tax if structured properly.

- Competitive Yields: The crediting rates on BOLI policies often surpass the net yields of equivalent low-risk investments, helping to boost overall returns.

- Key-Person Protection: In the event of a key executive’s death, the tax-free benefit can offset financial risks or contribute to business continuity strategies.

- Regulatory Clarity: Foundational guidance such as 12 USC 24 (Seventh) and OCC 2004-56 affirms the permissibility of BOLI as an investment, as long as banks follow recommended due diligence and risk management practices.

By understanding these core elements, bank executives and board members can better appreciate how BOLI fits into broader financial and strategic initiatives, from capital planning to talent retention.

Table of contents

- 1. Introduction of B ank Owned Life Insurance Policies

- 2. Understanding Bank-Owned Life Insurance

- Ready to Explore Whether Bank-Owned Life Insurance Fits Your Strategy?

- Ready to Strengthen Your Bank’s Capital Strategy?

- 4. Regulatory Considerations

- 5. Implementation Best Practices

- 6. Potential Risks and Considerations

- 7. Conclusion

- Ready to Explore Whether Bank-Owned Life Insurance Fits Your Strategy?

2. Understanding Bank-Owned Life Insurance

When it comes to implementing a Bank-Owned Life Insurance (BOLI) strategy, it’s crucial to understand exactly how these policies work, who owns them, why they’re so appealing, and what specific product types exist. In this section, we’ll examine each of these aspects in detail, ensuring you have a comprehensive view of BOLI’s role in financial institutions.

How BOLI Works:

The Basic Structure

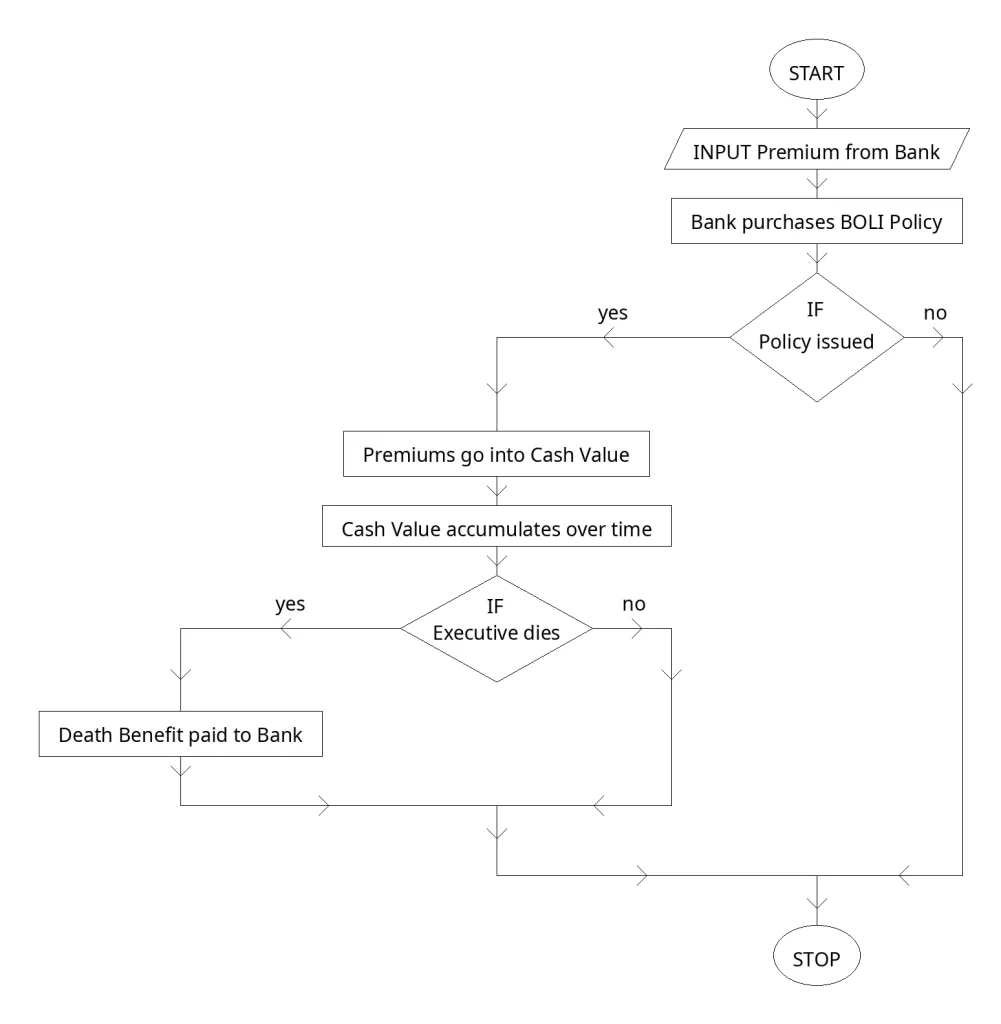

At its core, BOLI is a life insurance policy purchased by a financial institution on the lives of key employees—often executives or those whose loss could pose a financial risk to the bank. Here’s a step-by-step breakdown of how BOLI typically functions:

- Policy Purchase: The bank identifies eligible employees (sometimes referred to as “key persons”) and obtains their consent to insure their lives.

- Premium Payments: The financial institution pays the policy premiums. These premiums are usually a one-time lump sum (single premium) or can be spread out over several years.

- Cash Value Accumulation: Inside the policy, a “cash value” grows over time. This accumulation is tax-deferred, which means gains are not taxed as long as the money remains in the policy.

- Death Benefit: Upon the death of an insured employee, the bank receives the policy’s death benefit—generally free from federal income tax. In some cases, the bank may share a portion of these proceeds with the employee’s beneficiaries, though it’s not a requirement.

Long-Term Holding for Maximum Benefit

A vital point about BOLI is that its greatest advantages—particularly the tax-free nature of the death benefit—are typically realized by holding the policy until the insured individual’s death. If a policy is surrendered early, the bank may face taxes on any gains and potential surrender charges, which can substantially diminish the financial benefits.

Frequently Asked Questions

- What if the insured employee leaves or retires?

The policy ownership stays with the bank, though the institution should review the arrangement to determine if continuing to insure a former employee still makes strategic sense. Some banks maintain the policy because it can still accumulate value and provide eventual death benefits, while others may opt to exchange or surrender it, weighing the financial implications. - Do employees need to consent?

Yes. Insurable interest laws typically require written consent from the insured individual. Beyond compliance, obtaining consent fosters transparency and trust.

Policy Ownership & Beneficiary Details

Ownership

- Policy Owner: The bank or credit union itself is the owner of the life insurance policy. This means the institution pays premiums, makes decisions about policy changes, and can access or borrow against the policy’s cash value (subject to policy terms and potential tax consequences).

Beneficiary

- Primary Beneficiary: In almost all cases, the financial institution is named as the primary beneficiary, receiving the full or majority share of the death proceeds.

- Optional Shared Benefits: Some banks choose to offer a “split-dollar” arrangement or partial death benefit to the insured employee’s family. Though not mandatory, this can reinforce an employee retention strategy by providing an additional layer of personal life insurance coverage to key staff members.

Frequently Asked Questions

- Why might a bank share the death benefit?

This can serve as a powerful retention and recruitment tool, effectively supplementing an executive’s compensation package. - Who pays the taxes, if any?

Since the bank owns the policy, it is responsible for any tax implications (e.g., if a policy is surrendered prematurely). However, if held until the insured’s passing, the death benefit is generally tax-free to the institution, provided all regulatory requirements are met.

Read more about our philosophy and team approach on our Who We Are page.

Key Reasons Institutions Opt for BOLI

- Income Generation

- Higher Returns Than Traditional Investments: Yields can surpass after-tax returns on comparable investment vehicles (e.g., Treasuries, municipal bonds) by 125–300 basis points, thanks to the favorable tax-deferred buildup of the policy’s cash value.

- Cost Offset

- Employee Benefit Funding: The accumulated earnings within a BOLI policy can help offset the rising costs of employee benefits, including healthcare, retirement plans, and nonqualified deferred compensation.

- Long-Term Savings: By creating a robust internal funding source, institutions can reduce reliance on external funding or more volatile income streams.

- Portfolio Stability

- Diversification: BOLI’s cash value growth is generally less correlated with traditional market-driven assets, offering a measure of stability within the institution’s broader investment portfolio.

- Potential Hedge Against Interest Rate Fluctuations: Many BOLI policies have crediting rates that adjust based on market conditions, helping the institution avoid the full impact of interest rate volatility.

- Key-Person Protection

- Risk Mitigation: If a critical employee passes away, the bank recoups the financial impact through the policy’s death benefit. This can cover recruitment, training of replacements, or other transitional costs tied to the sudden loss of vital talent.

- Regulatory Clarity

- Supportive Guidelines: Under 12 USC 24 (Seventh) and OCC 2004-56, BOLI is recognized as a permissible activity for banks—provided rigorous due diligence, appropriate documentation, and ongoing oversight are maintained.

Ready to Explore Whether Bank-Owned Life Insurance Fits Your Strategy?

Schedule a complimentary consultation with our BOLI experts today. Let us assess your bank’s unique goals and outline a tailored plan to optimize your capital, enhance employee benefits, and boost your long-term returns.

🔥 An Estimated 4 Billion Dollars of Premium Will be put into BOLI’s in 2025

Types of BOLI Products

While the overarching concept of BOLI remains the same across product variations, the underlying investment arrangements and risk profiles can differ significantly. Understanding these categories helps CFOs, CEOs, and board members determine which structure aligns best with their institution’s goals and risk appetite.

- General Account BOLI

- Guaranteed Minimum Rate: The insurance carrier guarantees a minimum crediting rate on the cash value, offering predictability.

- Less Investment Transparency: Funds are pooled within the carrier’s general account, making it harder to track specific underlying investments.

- Carrier Risk: Because assets are in the carrier’s general account, they may be exposed to the carrier’s financial condition and creditor claims.

- Separate Account BOLI

- Greater Investment Transparency: Premiums are invested in a dedicated “separate account” portfolio, which can be tailored or selected to match the bank’s risk preferences.

- No Guaranteed Minimum Rate: While offering potentially higher returns, separate account policies typically don’t feature a guaranteed crediting floor.

- Insulation from Carrier Creditors: Assets in a separate account are generally protected from the insurance company’s creditors, providing enhanced security.

- Hybrid Account BOLI

- Combines Elements of Both: Hybrid accounts merge features of general and separate accounts, often providing partial investment transparency with some level of guaranteed return.

- Stable Value Riders: Many hybrid products include riders that help stabilize returns in different market conditions, offering a balance between risk and reward.

- Carrier Protection Features: Hybrids can be designed to be insulated from carrier creditors, similar to separate accounts, while still delivering a modest guaranteed rate.

Selecting the Right Product

Deciding between general, separate, or hybrid account BOLI comes down to factors like:

- Risk Tolerance: How comfortable is the institution with market fluctuations or varying crediting rates?

- Desire for Transparency: Does the board want granular insight into the underlying investments?

- Liquidity Needs: Is the bank comfortable holding the policy for the long term, or might it need access to cash value earlier?

- Regulatory and Capital Considerations: Each product type might carry different implications for how it’s treated on the balance sheet and how regulators view the associated risks.

Final Thoughts on Section 2

Understanding the mechanics of BOLI is the bedrock of a successful implementation. By recognizing the role of key-person coverage, tax advantages, and potential yield enhancements, financial leaders can better appreciate how BOLI fits into their institution’s overall strategic framework. With careful selection of the right product type—be it general, separate, or hybrid—and a thorough grasp of ownership and beneficiary details, executives can unlock the full potential of BOLI as a stable, long-term asset that fortifies the balance sheet and supports employee benefit programs.

In the next sections, we’ll delve into how BOLI influences capital optimization, employee retention, and other strategic considerations, followed by regulatory guidance and best practices to ensure your BOLI program remains compliant, transparent, and aligned with institutional objectives.

3. Key Benefits for CFOs, CEOs, and Board Members

Understanding how Bank-Owned Life Insurance (BOLI) can support a financial institution’s objectives is critical for top executives and board members. BOLI not only helps optimize the balance sheet but also serves as a potent tool for attracting and retaining top talent, among other advantages. Below, we explore four primary benefits—Capital Optimization, Enhanced Employee Retention, Tax Advantages, and Balance Sheet Management—while addressing common questions that arise in each area.

3.1 Capital Optimization

Impact on Tier 1 Capital

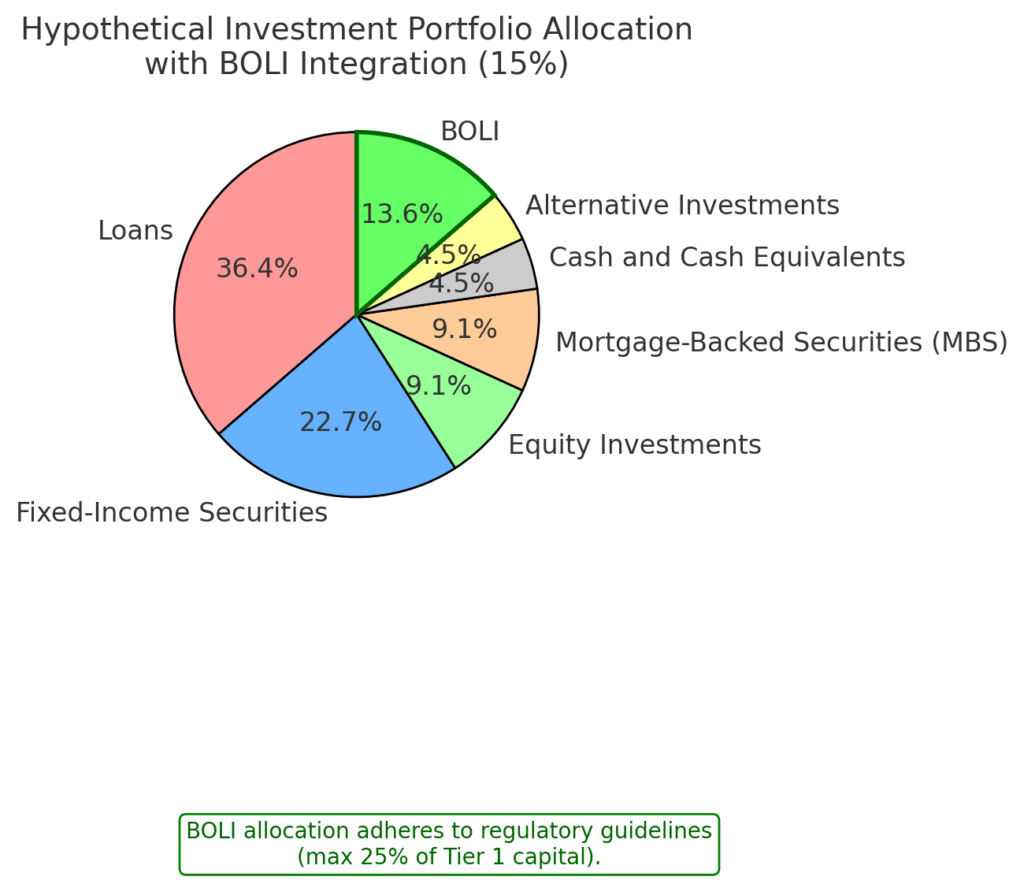

- Contribution to Core Capital: BOLI is recorded as an “other asset” on a bank’s balance sheet. Over time, the policy’s growing cash value can positively influence the bank’s overall capital profile. While it doesn’t directly boost Tier 1 capital in the same way as shareholder equity, the stable nature of BOLI earnings can improve return on assets (ROA) and strengthen the bank’s net worth position.

- Regulatory Recognition: Regulators typically view BOLI as a permissible long-term asset, provided that the bank follows proper due diligence and diversification guidelines. This regulatory acceptance helps ensure that gains from BOLI can be factored into broader capital management strategies without running afoul of supervisory expectations.

Frequently Asked Questions

- How does BOLI affect my bank’s capital ratios?

BOLI’s cash value increases over time and is recognized on the balance sheet, which can help maintain or improve ratios by enhancing overall asset quality. However, it’s vital to keep these policies within regulatory concentration limits. - Do regulators limit how much BOLI a bank can own?

Yes. Most guidance suggests keeping BOLI holdings within a reasonable proportion of the bank’s capital (often 25% or less of Tier 1 capital) to avoid concentration risk.

Enhancing Liquidity

- Long-Term Asset with Potential Accessibility: While BOLI should ideally be held until the insured’s death to realize its maximum tax benefits, the policy’s cash value can sometimes be accessed via loans or partial withdrawals. This might serve as a supplementary source of liquidity in unforeseen circumstances, though it may trigger taxes or surrender charges if not managed properly.

- Efficient Use of Funds: Compared to other long-term investments, the tax-deferred nature of BOLI and historically competitive crediting rates can make it a more efficient allocation of bank capital. By placing funds into an asset that reliably grows over time, CFOs and CEOs can free up other resources for immediate lending or operational initiatives.

Frequently Asked Questions

- Is BOLI considered a liquid asset?

BOLI is generally seen as a long-term holding; however, partial surrenders or policy loans may provide some access to cash. Still, these moves can diminish the policy’s tax advantages and future growth potential. - Does borrowing against the policy affect the death benefit?

Yes. Policy loans typically reduce both the cash value and the death benefit if not repaid, which could erode part of the institution’s expected benefits.

3.2 Enhanced Employee Retention

Funding Executive Benefits & Compensation Programs

- Nonqualified Deferred Compensation (NQDC) Plans: BOLI earnings can be used to offset or fully fund the costs of NQDC arrangements, where select executives defer a portion of their compensation or bonuses. These plans can help recruit and retain top talent by promising future financial rewards tied to the institution’s performance.

- Supplemental Executive Retirement Plans (SERPs): Similar to NQDC, SERPs are specialized retirement packages often offered to senior executives. Income generated by BOLI can effectively subsidize these costs without directly impacting day-to-day operating expenses.

Frequently Asked Questions

- Why use BOLI to fund benefit programs instead of other investments?

Because BOLI grows tax-deferred, it can yield a higher net return than many competing investments. This additional yield makes it particularly attractive for offsetting employee benefit costs while preserving capital. - Are there compliance considerations for using BOLI in benefit programs?

Yes. The board must ensure proper documentation and adherence to all regulatory guidelines. This typically includes confirming the insurable interest, obtaining employee consent, and conducting a thorough pre-purchase analysis.

Aligning Leadership Interests

- Retention & Recruitment: Offering a robust suite of benefits, underpinned by BOLI-funded plans, helps align executives’ long-term financial incentives with the institution’s success. The promise of enhanced retirement benefits or supplemental compensation can differentiate your bank or credit union from competitors.

- Key-Person Coverage: By designating the institution as the beneficiary, BOLI safeguards against financial disruption if a high-impact executive or critical employee passes away prematurely. The death benefit can fund transitional costs, including recruitment and training of new leadership.

Frequently Asked Questions

- Do employees receive direct life insurance benefits from BOLI?

In most arrangements, the bank is the direct beneficiary; however, some institutions opt to share a portion of the death proceeds with the employee’s estate or family. This approach can further boost morale and loyalty. - Does BOLI replace standard group life insurance for employees?

No. BOLI typically supplements rather than replaces a group life policy. The primary purpose is to protect the bank’s financial interests and fund executive benefits, though it can be structured to offer additional coverage to employees under split-dollar arrangements.

3.3 Tax Advantages

Tax-Deferred Cash Value Growth

- Accelerated Accumulation: Because policy gains remain untaxed until surrendered, the cash value can compound more efficiently. Over a span of years—or decades—this advantage can significantly outpace comparable taxable investments.

- No Ongoing Tax Liabilities: The bank generally does not pay annual taxes on interest or dividend credits within the BOLI policy, freeing up more capital to remain invested.

Frequently Asked Questions

- What happens if we surrender the policy prematurely?

Any gains to date become taxable upon surrender. Surrender charges may also apply, reducing the net proceeds. - Are there any alternative tax structures for BOLI?

Most BOLI follows a uniform set of tax rules governed by the Internal Revenue Code. However, institutions may explore various product types (general account, separate account, hybrid) for differences in crediting rates, fees, and asset protection.

Tax-Free Death Benefit

- Significant Lump-Sum Proceeds: If the policy remains in force until the insured’s passing, the death benefit is generally paid out to the bank free from federal income tax, subject to compliance with IRS regulations and policy ownership rules.

- Offsetting Key-Person Loss & Employee Benefits: Institutions often use these proceeds to compensate for lost productivity, recruitment costs, or to replenish funds spent on employee benefit obligations.

Frequently Asked Questions

- Under what conditions is the death benefit tax-free?

Generally, the death benefit is free from federal income tax if the policy has not been transferred for value and if the bank has met all notice and consent requirements prior to policy issuance. - Do state taxes apply?

While most states follow similar guidelines, tax treatment can vary. Consulting with a tax advisor ensures compliance with local regulations and helps navigate any special circumstances.

3.4 Balance Sheet Management

Stable Asset for Diversification

- Low Correlation with Traditional Markets: BOLI performance is tied to insurance carrier crediting rates rather than directly to stock or bond market indices, offering a measure of stability.

- Long-Term Consistency: Because BOLI is intended as a multi-decade holding, it provides a steady earning stream that can smooth out short-term fluctuations in other asset classes.

Frequently Asked Questions

- How does BOLI fit into an asset-liability management (ALM) strategy?

The relatively predictable growth rate helps balance the volatility of other investments, improving overall ALM performance. Proper board oversight ensures BOLI assets remain within approved risk parameters. - What about changes in interest rates?

While BOLI crediting rates can adjust, they often lag behind immediate market swings. This “sticky” nature can be advantageous in volatile rate environments, but it’s also important to periodically review policy performance.

Reduced Exposure to Interest Rate Fluctuations

- Competitive Crediting Rates: Insurance carriers generally set BOLI crediting rates with a long-term outlook, which can protect the bank from short-term rate spikes or drops.

- Predictable Earnings: Unlike many investment vehicles, BOLI tends not to experience dramatic valuation swings, improving forecast accuracy for the bank’s income projections.

Frequently Asked Questions

- Can the crediting rate on BOLI drop unexpectedly?

While carriers typically strive for stable crediting rates, economic conditions can affect returns. Annual or periodic policy reviews help institutions respond proactively if rates become uncompetitive. - Is there an upside to rising rates?

Yes. In many cases, BOLI policies may adjust to reflect improved market yields over time, potentially increasing the cash value’s growth rate.

Final Thoughts on Section 3

For executives and board members, the strategic value of BOLI lies in its blend of higher-yielding tax-deferred growth, risk mitigation, and long-term stability. By carefully structuring policies to align with the institution’s unique goals—whether that’s bolstering capital ratios, funding executive benefit programs, or guarding against the financial impact of losing a key employee—BOLI can play a central role in a well-rounded financial strategy.

In the following sections, we’ll explore the regulatory landscape, best practices for implementation, and other considerations to ensure your BOLI program delivers maximum benefits while remaining fully compliant with industry guidelines.\

Ready to Strengthen Your Bank’s Capital Strategy?

Call Us Now at 740-331-7688 Or Click Below Schedule Your Consultation

✓ Discover how Bank-Owned Life Insurance can help fund benefits, mitigate risk, and boost returns.

4. Regulatory Considerations

Bank-Owned Life Insurance (BOLI) is widely recognized as a permissible, long-term investment for financial institutions, but it operates under a specific set of regulations and guidance. Compliance is paramount—overlooking any aspect of the regulatory framework can lead to costly fines, reputational damage, or forced policy divestitures. In this section, we’ll review the key guidelines, the importance of thorough risk assessments, and how to ensure your institution remains in good standing with all relevant agencies.

4.1 Adherence to OCC, Federal Reserve, and State Regulations

12 USC 24 (Seventh)

- National Bank Authority: Under 12 USC 24 (Seventh), national banks are permitted to purchase life insurance if it serves a legitimate business purpose and aligns with safe and sound banking practices. This legislative framework underpins much of the OCC’s guidance on BOLI.

- Business Purpose Requirement: Common business purposes for BOLI include offsetting the costs of employee benefit obligations, mitigating key-person risk, and enhancing an institution’s overall financial stability.

OCC Bulletin 2004-56

- Due Diligence Requirements: The Office of the Comptroller of the Currency (OCC) outlines key components of a thorough pre-purchase analysis, including the evaluation of carrier financials, policy design, and stress testing.

- Risk Management Policies: Banks must establish written policies detailing how BOLI fits into their broader risk management framework. These policies generally address acceptable concentration limits, annual policy reviews, and board oversight.

- Ongoing Monitoring: OCC guidance specifies that banks should regularly review carrier ratings, crediting rates, and the policy’s overall performance. Institutions must document these reviews to demonstrate proactive management.

Federal Reserve, FDIC, and NCUA Guidelines

- Similar Principles: Although guidance may differ slightly across regulators (e.g., Federal Reserve for bank holding companies, FDIC for state non-member banks, NCUA for credit unions), they largely mirror the OCC’s emphasis on due diligence, permissible purposes, and risk oversight.

- Capital Considerations: Different regulators may have varying interpretations of how BOLI is categorized for capital ratio purposes. In most cases, BOLI is listed as an “other asset,” and institutions should confirm how its presence impacts their specific capital framework.

State Insurance Regulations

- Carrier Oversight: Insurance carriers themselves must comply with state insurance department regulations. Financial institutions should confirm that their chosen carrier is in good standing within the states where they operate.

- Insurable Interest & Consent: States often have specific rules about insurable interest and consent forms, ensuring that banks are not purchasing life insurance without the employee’s knowledge.

4.2 Importance of Thorough Risk Assessment and Ongoing Compliance

Board-Level Oversight

- Governance and Documentation: Regulators expect board members to set clear policies regarding BOLI ownership, including defining acceptable purposes, maximum investment thresholds, and mandatory reporting protocols.

- Fiduciary Responsibility: Boards must ensure that any BOLI holdings align with the institution’s broader strategic objectives and do not jeopardize its financial standing. Written policies, minutes from board meetings, and audit trails all serve as evidence of prudent oversight.

Pre-Purchase Analysis

- Carrier Evaluation: Assess an insurance carrier’s credit rating, financial strength, and track record of stable performance. Look for carriers rated highly by A.M. Best, Moody’s, Standard & Poor’s, or Fitch.

- Policy Design: Examine whether a general account, separate account, or hybrid approach fits the bank’s risk profile. A cost-benefit analysis should factor in policy fees, crediting rates, surrender charges, and any riders (e.g., stable value riders).

- Stress Testing: Institutions should consider worst-case scenarios, such as economic downturns or a downgrade in the carrier’s credit rating, to ensure the policy remains viable even under stress.

Concentration Limits and Safe & Sound Banking Practices

- Avoiding Over-Reliance on BOLI: While BOLI can provide strong yields, regulators generally recommend limiting BOLI to a certain percentage of Tier 1 capital (commonly cited as no more than 25%), though specifics may vary by institution size and risk appetite.

- Periodic Reviews: The bank should revalidate its BOLI concentration against its strategic goals and current capital position. If the concentration exceeds internal or regulatory guidelines, management might need to cease premium payments, reduce coverage, or seek alternative funding solutions.

FASB Technical Bulletin No. 85-4 (Accounting Guidance)

- Financial Statement Treatment: According to FASB’s Technical Bulletin No. 85-4, BOLI is recorded as an “other asset” on the balance sheet, and policy increases are typically reflected as “other income.”

- Impairment Considerations: Institutions must also monitor any conditions that might necessitate recognizing an impairment, such as a carrier’s insolvency risk or negative changes in policy value.

Annual and Ongoing Monitoring

- Performance Metrics: Track cash surrender value, crediting rates, and policy expenses regularly. If returns fall below expectations—or if the carrier’s financial condition deteriorates—consider alternatives, like a 1035 exchange.

- Regulatory Compliance: Maintain up-to-date documentation, including board approvals, consent forms, and annual reviews. Thorough record-keeping can demonstrate compliance if examined by regulators or auditors.

Frequently Asked Questions (FAQ) on Regulatory Compliance

- What is the biggest risk in failing to comply with BOLI regulations?

The most significant risk is regulatory scrutiny leading to fines, forced divestiture of policies, or reputational harm. Non-compliance can also erode stakeholder confidence and damage relations with regulators. - Do we need to update our BOLI documentation annually?

Yes. Regulators expect periodic reviews (often annually) of policy performance, carrier ratings, and alignment with your institution’s strategic objectives. Any changes or updates should be formally documented in board minutes or internal governance reports. - Is there a standard template for the pre-purchase analysis?

While there is no single universal template, regulators often provide guidelines or checklists. Many institutions also engage specialized BOLI consultants, legal advisors, or actuaries to ensure that all aspects—financial, legal, and administrative—are thoroughly evaluated. - How can we confirm our carrier meets regulatory standards?

Check independent rating agencies (A.M. Best, Moody’s, S&P, Fitch) for consistent, high credit ratings. Additionally, confirm the carrier has a solid history of honoring its contractual obligations and stable crediting rates.

Final Thoughts on Section 4

Regulatory oversight ensures that BOLI remains a safe and sound investment tool rather than a speculative venture. By understanding and complying with guidelines from the OCC, Federal Reserve, FDIC, NCUA, and state insurance departments, institutions can confidently integrate BOLI into their long-term strategies. Establishing robust governance, conducting rigorous pre-purchase analyses, and performing annual policy reviews are not just best practices—they’re essential safeguards that protect both the bank’s financial health and its reputation.

In the upcoming sections, we’ll explore how to implement BOLI best practices, manage potential risks, and ultimately capitalize on the strategic benefits while remaining compliant with the regulatory framework.

5. Implementation Best Practices

Successfully implementing a Bank-Owned Life Insurance (BOLI) program demands a well-defined process that considers carrier selection, ongoing policy management, proper governance, and alignment with your institution’s broader strategic goals. In this section, we’ll delve into each of these best practices, address common questions, and underscore the key factors you should prioritize to safeguard both financial and regulatory outcomes.

5.1 Carrier Selection

Why Carrier Choice Matters

The insurance carrier is central to your BOLI strategy, as its stability and creditworthiness directly influence the policy’s performance and long-term viability. Choosing a top-rated carrier minimizes default risk and enhances the predictability of crediting rates.

Key Considerations

- Financial Strength & Ratings

- Check Multiple Agencies: Review ratings from A.M. Best, Moody’s, Standard & Poor’s, and Fitch. Look for carriers consistently rated in the upper tiers (e.g., “A” or above).

- Historical Performance: Investigate the carrier’s track record of paying claims, maintaining stable crediting rates, and managing its investment portfolio.

- Portfolio Composition & Strategy

- General vs. Separate Accounts: Inquire about the carrier’s allocation strategies and whether they are concentrated in certain sectors or diversified across asset classes.

- Risk Management Approach: Ensure the carrier has robust policies for interest rate hedging, liquidity management, and stress testing.

- Service & Reporting

- Policy Administration: Assess the carrier’s administrative platforms, digital capabilities, and responsiveness to service requests.

- Reporting Frequency: Look for carriers that provide transparent, timely reports on policy performance, crediting rates, and fees.

Frequently Asked Questions

- How many carriers should we consider?

Most institutions solicit proposals from at least two or three carriers for comparison, ensuring competitive pricing and a better understanding of potential policy variations. - What if a carrier’s rating is downgraded?

If the downgrade is significant, consider transferring the policy via a 1035 exchange to preserve tax benefits. Always weigh potential surrender charges and the new carrier’s fees.

5.2 Regular Policy Review

Importance of Ongoing Evaluations

BOLI is not a “set it and forget it” investment. Regular reviews help confirm that the policy remains competitive, complies with regulatory requirements, and aligns with your institution’s evolving strategic goals.

Review Components

- Cash Value Growth & Credit Rates

- Comparative Benchmarking: Compare your BOLI’s actual returns against its original projections and other bank-eligible investments to gauge performance.

- Crediting Rate Changes: Determine whether increases or decreases in the crediting rate align with broader market trends and your institution’s expectations.

- Carrier Financial Health

- Rating Updates: Track any changes in the carrier’s credit rating or outlook, and perform periodic due diligence to ensure ongoing alignment with your risk tolerance.

- Solvency & Reserve Ratios: Investigate whether the carrier maintains healthy reserve ratios and a stable investment portfolio.

- Regulatory Compliance

- Concentration Limits: Confirm that your BOLI holdings don’t exceed approved percentages of Tier 1 capital or other regulatory thresholds.

- Documentation & Board Oversight: Ensure all policy reviews, changes, and performance updates are discussed at board or committee meetings and recorded in meeting minutes.

Frequently Asked Questions

- How often should we review our BOLI policies?

Many institutions conduct formal reviews at least annually. Some perform semi-annual or quarterly updates, especially when crediting rates or carrier ratings fluctuate. For additional insights on financial planning and industry trends, explore our Blog for more articles. - What if the policy underperforms?

If returns lag significantly, investigate potential causes—such as carrier performance, fees, or policy structure. A 1035 exchange could be viable if it aligns with your institution’s strategic and regulatory constraints.

5.3 Documented Governance

Board Oversight & Policy Framework

A robust governance framework provides a structured approach to managing BOLI. Regulators scrutinize these processes to ensure the institution acts prudently and consistently with safe and sound banking practices.

Key Governance Elements

- Formal Resolutions & Policies

- Purchase Authorization: Document the board’s approval for acquiring or exchanging BOLI policies, ensuring a clear audit trail.

- Permissible Uses & Limits: Outline acceptable coverage amounts, concentration limits, and risk thresholds in a written policy accessible to senior management.

- Reporting & Transparency

- Periodic Reporting: Provide the board or a designated oversight committee with regular updates on cash surrender values, crediting rates, carrier ratings, and overall performance.

- Employee Consent & Privacy: Maintain signed consent forms and respect any privacy regulations related to medical underwriting or personal data.

- Accountability & Role Definition

- Assign Responsibilities: Clearly designate who is responsible for reviewing carrier performance, who manages policy loans or surrenders, and who liaises with regulators. Meet our specialists who help institutions navigate these decisions on our Team page.

- Succession Planning: Identify backups or successors for key roles to ensure continuity in the event of staff turnover.

Frequently Asked Questions

- Is a separate committee necessary for BOLI oversight?

Many institutions integrate BOLI oversight into an existing board committee (e.g., investment or risk committee). Others establish a dedicated subcommittee. The critical factor is ensuring that knowledgeable individuals regularly review the program. - Can we outsource some of these governance tasks?

Yes. Institutions often enlist third-party administrators or consultants for policy tracking, compliance checks, and reporting. However, the board retains ultimate responsibility.

5.4 Integration with Strategic Initiatives

Aligning BOLI with Broader Goals

BOLI policies should complement—not compete with—your institution’s overarching strategies. By intertwining them with capital planning, mergers and acquisitions, or talent management programs, you can maximize the return on investment.

Potential Strategic Applications

- Mergers & Acquisitions

- Funding Post-Merger Obligations: Use BOLI earnings to cover enhanced benefits or retirement costs resulting from consolidation.

- Balance Sheet Resilience: The stability of BOLI returns can help strengthen the merged entity’s capital position.

- Capital Management

- Supplemental Income Stream: BOLI earnings can improve the institution’s non-interest income, supporting balanced growth even during low-rate environments.

- Regulatory Cushion: Steady returns from BOLI can offset capital depletion during volatile market cycles or economic downturns.

- Executive Compensation & Retention

- Attracting Top Talent: Robust benefits funded by BOLI help position your institution as a premier employer in the financial sector.

- Aligning Incentives: When performance-based compensation is tied to long-term programs funded by BOLI, executives have a vested interest in supporting sustainable growth.

Frequently Asked Questions

- Is BOLI a viable tool in uncertain economic times?

Yes. While no investment is entirely recession-proof, BOLI’s crediting rate often remains stable relative to other assets, providing a buffer against market volatility. - How do we ensure BOLI remains effective as our institution evolves?

Conduct regular strategic reviews to confirm that the policy still aligns with your capital goals, workforce needs, and risk tolerance. Adjust or replace policies as circumstances change, keeping an eye on surrender charges, tax implications, and regulatory guidelines.

Final Thoughts on Section 5

Implementing a successful BOLI program is as much about process and oversight as it is about selecting a high-quality insurance product. By rigorously vetting carriers, scheduling regular policy reviews, establishing clear governance structures, and weaving BOLI into your institution’s broader strategies, you can harness its potential to enhance capital stability, fund employee benefits, and strengthen your overall financial position.

Next, we’ll examine potential risks, regulatory pitfalls, and additional considerations you should keep in mind to maintain a robust, compliant BOLI program.

6. Potential Risks and Considerations

While Bank-Owned Life Insurance (BOLI) can offer robust returns, tax advantages, and balance sheet stability, it’s not without risks. Understanding these potential pitfalls—and planning around them—is key to preserving the value of your institution’s investment. In this section, we will discuss four primary areas of concern: concentration risk, regulatory scrutiny, interest rate environments, and the consequences of early surrender.

6.1 Recognizing Concentration Risk

Over-Reliance on BOLI as an Asset

- Capital Exposure: When a significant percentage of an institution’s capital is tied up in BOLI, a carrier downgrade or a spike in policy fees can disproportionately affect the balance sheet.

- Regulatory Guidelines: Many regulators encourage banks to keep BOLI at or below 25% of Tier 1 capital. Exceeding this threshold may invite heightened supervisory attention.

Diversification Strategies

- Multiple Carriers: Instead of purchasing multiple policies from a single insurer, diversify among carriers to spread risk.

- Product Variety: Consider using both general account and separate account (or hybrid) BOLI policies, which offer different risk and return profiles.

Frequently Asked Questions

- What happens if BOLI exceeds recommended concentration limits?

Regulators may request additional justification or require you to reduce your holdings. Exceeding limits could also raise questions about your institution’s risk management practices. - Is it possible to rebalance BOLI holdings without penalties?

In some cases, a 1035 exchange allows you to move from one policy or carrier to another without triggering taxable gains. However, surrender charges or new underwriting requirements may still apply.

6.2 Navigating Regulatory Scrutiny

Importance of Ongoing Compliance

- Annual Examinations: Regulators often review BOLI during routine bank examinations. Keeping thorough records and showing consistent board oversight can help demonstrate compliance.

- Documentation & Governance: Transparent policies, robust board involvement, and regular performance reviews are essential to fend off allegations of lax oversight.

Potential Consequences of Non-Compliance

- Fines and Penalties: Failure to follow guidelines—such as obtaining employee consent or properly documenting the business purpose—can result in monetary penalties.

- Reputational Damage: Public disclosure of regulatory issues can erode trust among shareholders, customers, and the broader market.

Frequently Asked Questions

- What are the key red flags regulators look for?

Common red flags include inadequate documentation of due diligence, unclear policy objectives, inconsistent board oversight, and excessive BOLI concentration. - Does each regulator have a different view on BOLI?

The OCC, Federal Reserve, FDIC, and NCUA generally share similar guidelines, although emphasis can vary. Always confirm your specific regulator’s expectations to ensure full compliance.

6.3 Monitoring the Interest Rate Environment

Impact on Policy Performance

- Crediting Rate Adjustments: Although BOLI interest-crediting rates are often stable, they can shift based on market dynamics. A sustained low-rate environment may reduce policy growth, while rising rates could improve returns—but not always immediately.

- Policy Illustration vs. Reality: Initial proposals often include optimistic crediting rate projections. Regular reviews will confirm whether actual performance aligns with those forecasts.

Hedging Against Rate Fluctuations

- Separate Account Options: By investing in a separate account BOLI product, institutions can select asset mixes that mitigate sensitivity to rate changes.

- Stable Value Riders: Some BOLI policies include riders that maintain a more consistent rate of return, even in volatile markets.

Frequently Asked Questions

- Can interest rate changes drastically reduce BOLI returns?

It’s possible if the carrier lowers the crediting rate substantially. However, many carriers aim to maintain steady rates to remain competitive. - How often do carriers adjust crediting rates?

This varies by carrier and policy type. Some adjust rates quarterly, while others do so semi-annually or annually. Always review policy documents to understand how often crediting rates can change.

6.4 Early Surrender Consequences

Tax Implications and Surrender Charges

- Taxable Gains: If a policy is surrendered before the insured’s death, any accumulated gains become immediately taxable. This can erode much of the financial benefit gained from tax-deferred growth.

- Surrender Fees: Some policies impose steep surrender charges during the early years, which can reduce or negate the policy’s cash surrender value.

Long-Term Focus

- Maximizing Value: The greatest advantages of BOLI—especially the tax-free death benefit—are realized when the policy is held through the insured’s lifetime.

- Exit Strategies: If a carrier’s financial strength deteriorates or policy performance is consistently weak, consider a 1035 exchange rather than a full surrender, as this allows the bank to preserve accrued tax-deferred gains.

Frequently Asked Questions

- What if the insured employee leaves the company?

The bank still owns the policy and may continue to hold it if the potential gains outweigh the costs. Alternatively, the bank could explore a policy exchange or surrender, factoring in all financial implications. - Can partial surrenders or loans avoid penalties?

While partial withdrawals or loans may offer temporary liquidity, they can reduce both the cash value and the death benefit. Loans also need to be repaid (with interest) to preserve the policy’s original value.

Final Thoughts on Section 6

By proactively addressing concentration limits, maintaining clear regulatory compliance, monitoring the interest rate environment, and understanding the tax implications of early surrender, your institution can minimize many of the inherent risks associated with BOLI. A successful BOLI strategy is not just about capturing higher yields or offsetting benefit costs—it’s equally about prudent risk management and ensuring the program remains sustainable and beneficial in the long run.

In the next section, we’ll summarize the essential takeaways, highlight the importance of due diligence, and explore how professional guidance can tailor your BOLI program to meet your institution’s unique objectives.

7. Conclusion

Bank-Owned Life Insurance (BOLI) can serve as a powerful, multifaceted tool for financial institutions. When structured and managed correctly, it not only enhances balance sheet stability but also supports executive benefits, boosts non-interest income, and strengthens an institution’s overall strategic posture. However, BOLI’s advantages do not come without complexity—careful planning, rigorous oversight, and consistent alignment with regulatory guidelines are all prerequisites for long-term success.

7.1 Recap of BOLI’s Strategic Role

- Yield Enhancement

- BOLI’s crediting rates often outpace after-tax returns from traditional bank-eligible investments, providing an opportunity to improve net interest margins.

- Tax-deferred cash value growth and the potential for a tax-free death benefit (when held until the insured’s passing) can yield significant financial gains over time.

- Employee Retention & Executive Compensation

- By funding nonqualified deferred compensation plans or supplemental executive retirement plans, BOLI strengthens the institution’s ability to attract and retain top talent.

- Key-person coverage through BOLI can help cushion the bank from the financial shocks associated with the unexpected loss of senior leadership.

- Capital & Balance Sheet Optimization

- When viewed as a long-term asset, BOLI can stabilize earnings and mitigate interest rate volatility.

- Its “other asset” classification can favorably contribute to capital ratios if held within regulatory concentration limits.

7.2 Importance of Due Diligence and Governance

- Regulatory Compliance

- Adhering to frameworks such as 12 USC 24 (Seventh), OCC 2004-56, and other agency-specific guidelines safeguards your institution against regulatory scrutiny and penalties.

- Thorough pre-purchase analysis—including evaluating carrier strength, policy type, and potential concentration risks—ensures your BOLI program remains safe and sound.

- Board-Level Oversight

- Effective governance involves setting formal policies on BOLI acquisition, reviewing policy performance regularly, and maintaining comprehensive documentation.

- Clear roles and responsibilities, along with transparent reporting, reassure regulators and stakeholders that BOLI assets are managed responsibly.

- Risk Management & Ongoing Reviews

- Regularly examining carrier ratings, policy crediting rates, and market conditions helps identify early warning signs, such as deteriorating carrier stability or underperforming cash value growth.

- Implementing a well-defined process for handling potential exits—through full surrender or 1035 exchanges—can preserve accrued benefits while aligning with evolving business objectives.

7.3 Encouragement for Tailored Solutions

Every financial institution has unique growth trajectories, risk tolerances, and talent management strategies. While the principles outlined throughout this guide offer a comprehensive framework, it is vital to adapt them to your bank or credit union’s specific circumstances. Ready to explore a tailored BOLI strategy? Reach out via our Contact page to start the conversation.

- Professional Guidance

- Consultants & Advisors: Engaging specialized BOLI consultants, actuaries, and legal counsel can help ensure each policy aligns with your strategic goals and regulatory environment.

- Customized Policy Design: Choose between general, separate, or hybrid accounts—along with stable value riders or other features—to match your institution’s risk appetite and cash flow needs.

- Long-Term Perspective

- Strategic Fit: Evaluate how BOLI complements your broader initiatives, from mergers and acquisitions to executive compensation plans.

- Sustainable Growth: A well-structured BOLI program remains an asset on the balance sheet for years—or even decades—serving as a cornerstone of financial resilience.

Final Thoughts on Section 7

BOLI’s potential for higher yields, tax advantages, and employee benefit funding can make it an invaluable component of your institution’s toolkit. Yet, these benefits hinge on rigorous due diligence, transparent governance, and alignment with overarching financial and strategic objectives. By maintaining a culture of accountability, proactively monitoring policy performance, and engaging the right experts, CFOs, CEOs, and board members can confidently leverage BOLI to strengthen their institution’s financial foundation and stay ahead in an ever-competitive marketplace.

- Definition of BOLI:

- Bank-Owned Life Insurance (BOLI) is a life insurance policy purchased and owned by a financial institution on the lives of key employees.

- Cash value growth in the policy is tax-deferred, and the death benefit is generally tax-free if the policy is held until the insured’s death.

- Purpose of the Introduction:

- Provide a high-level overview of why BOLI has gained traction among banks and credit unions.

- Outline the reasons CFOs, CEOs, and board members should consider BOLI, including tax benefits and yield advantages over traditional investments.

Ready to Explore Whether Bank-Owned Life Insurance Fits Your Strategy?

Schedule a complimentary consultation with our BOLI experts today. Let us assess your bank’s unique goals and outline a tailored plan to optimize your capital, enhance employee benefits, and boost your long-term returns.

🔥 An Estimated 4 Billion Dollars of Premium Will be put into BOLI’s in 2025