How To Choose a Financial Advisor in Columbus, Ohio

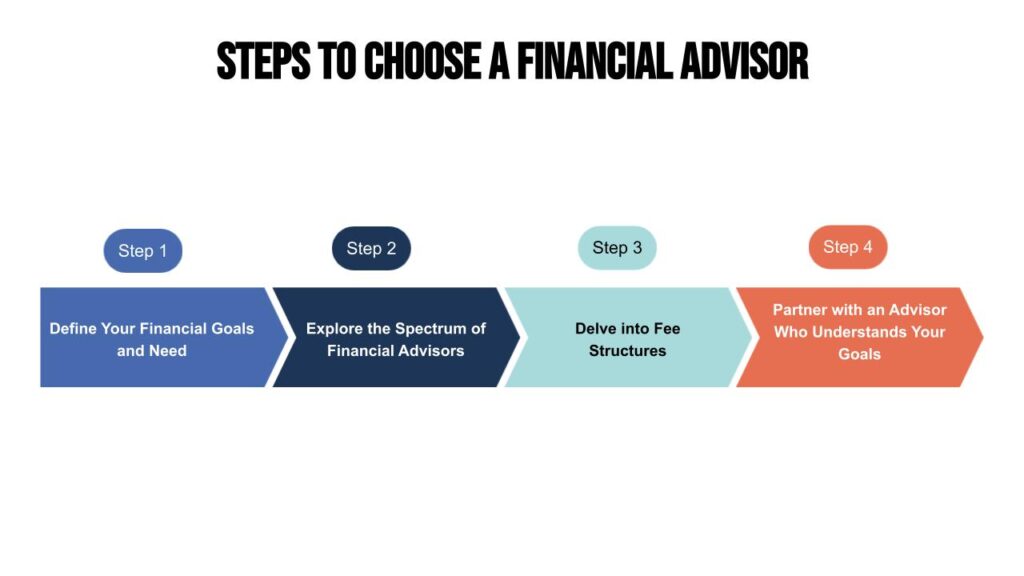

Thinking about how to choose the right personal financial advisor in Columbus, Ohio? You’re in the right place! Let’s break it down into simple steps so you can make a choice that fits your financial journey. From here we will go into more detail about how to go about each one of these steps. But we wanted you to be able to quickly review the nuances of what this article covers!

- Chart Your Financial Desires: Envision the financial future you’re aiming for. What milestones and objectives are on your financial horizon?

- Explore the Advisor Spectrum: The financial advisory world is diverse. Dive into the array of professionals available and discover the one who resonates with your financial ethos.

- Scrutinize the Cost and Commitment: Investigate not just what you’ll pay, but also whether your advisor pledges to prioritize your financial well-being above all else.

- Balance Value with Investment: Delve into what you’re truly receiving in exchange for your financial investment in an advisor. Is the service spectrum aligned with your expectations?

- Authenticate Your Advisor’s Credibility: Ensure the financial guide you’re considering is not only esteemed in their field but also genuinely equipped to navigate your financial landscape.

Looking for info on Bank Owned Life Insurance? Click Here To Jump Straight to that article.

A personal financial advisor adopts an all-encompassing approach to managing a client’s finances. Ensuring every aspect from investments, taxes, retirement, estate planning, to insurance is harmoniously integrated. They not only assess the entire financial landscape of a client but also collaborate with a network of professionals. Professionals like tax advisors, attorneys, and insurance agents, orchestrating a unified strategy that adapts to life’s changes. This approach not only aligns each financial decision with the client’s broader life goals but also educates and empowers the client. Providing a comprehensive, informed, and adaptable financial strategy.

Now, let’s dive deeper into each of these steps and explore how Reignmakers Wealth Advisors in Columbus can be the partner you’re searching for on this financial journey.

Feeling unsure about your financial future? You’re likely here because you’re in search of a new financial advisor. Or perhaps you’re contemplating a change due to dissatisfaction with your current one. At Reignmakers Wealth Advisors, we go beyond mere money management. We offer comprehensive financial planning to address all facets of your financial life, without burdening you with excessive fees. Our transparent, clear, and flexible fee structure ensures that you get the value and peace of mind you deserve.

Don’t settle for less—opt for an advisor who aligns with your financial aspirations. Connect with Reignmakers Wealth Advisors now and take the first step towards a financial strategy that’s tailored to your unique needs, crafted with your best interests at heart.

Navigating Your Financial Journey with Confidence

Embarking on a financial planning journey in Columbus is an adventure filled with potential and possibilities. In a city known for its vibrant economy and diverse opportunities, the decisions you make today can significantly impact your financial future. Whether you’re a seasoned business owner, an individual navigating the complexities of wealth management, or someone just beginning to explore the realm of financial planning, the importance of choosing the right financial advisor cannot be overstated.

Reignmakers Wealth Advisors has emerged as a guiding light in the financial landscape of Columbus, offering more than just advice—they provide a partnership designed to foster your financial growth and stability. Understanding that financial needs and goals are as diverse as the residents of here, Reignmakers prides itself on its inclusive approach. They believe that everyone, regardless of their financial status or background, deserves access to professional financial guidance.

At Reignmakers Wealth Advisors, the journey begins with a comprehensive initial consultation, a foundational step where understanding meets strategy. This crucial interaction is not just about numbers and data; it’s about listening to your stories, understanding your aspirations, and recognizing the challenges you face. It’s here that Reignmakers’ professionals tailor their approach, aligning their vast financial experience with your specific needs and dreams.

For business owners, Reignmakers offers a beacon of hope and clarity, providing strategies that encompass everything from asset optimization to tax planning, all designed to propel your business to new heights. Affluent individuals will find a partner in Reignmakers, one who understands the nuances of wealth management and legacy planning, ensuring that your financial future is as bright and secure as you envision. And for those just embarking on their financial journey, Reignmakers is a welcoming guide, demystifying the financial world and empowering you with the knowledge and tools to build a stable financial foundation.

This is a city where tradition meets innovation, Reignmakers Wealth Advisors stands out for its commitment to community, excellence, and personalized service. Choosing Reignmakers means embarking on a financial journey with confidence, knowing you have a partner dedicated to your success every step of the way. It’s not just about financial advice and financial planning; it’s about building a lasting relationship that will carry you confidently into the future, no matter what your financial goals may be.

Step-by-Step Guide: Finding Your Financial Advisor

Embark on your journey to financial clarity and success by following these systematic steps, ensuring you find an advisor who aligns with your unique needs and goals.

Step 1: Define Your Financial Goals and Needs

Embarking on the journey to find the right financial advisor for wealth management in Columbus starts with a deep dive into your own financial story. Begin by reflecting on your current financial standing. Understanding where you are today is pivotal in planning where you want to go.

Next, pinpoint your immediate financial priorities. These could range from sorting out your budget, saving for a down payment on a house, or getting the right insurance coverage. It’s all about identifying what matters most to you right now. If your unsure that’s ok too, and why you should seek a consultation with an advisor you feel meshes with you the best! The consolation will get your mind considering all realms of possibilities. You can even schedule multiple financial planning meetings with multiple advisors to get a well rounded view! Pro tip: While we say free consultation that fact is advisors don’t charge for consultations, we just like to say that because hey, who doesn’t like to be clear that the meeting wont cost anything!

Then, shift your focus to the horizon—your long-term financial aspirations. Are you dreaming of a retirement filled with travel and leisure, aiming to leave a substantial legacy, or perhaps planning for your children’s education? Your long-term goals will shape the kind of financial guidance you’ll need. This can be ever changing, don’t feel like your goals can never change!

With your goals laid out, it’s time to think about the specific services that will help you achieve them. Do you need someone to guide your investment decisions, offer tax planning advice, or assist with estate planning? Each goal might require a different expertise. Being armed with this knowledge will help you decide if you want holistic services or just a money manager for example.

Lastly, consider the complexity of your financial landscape. If your financial life includes elements like business ownership, real estate investments, or international assets, your needs will be more intricate than someone with a straightforward salary and a savings account. Therefore you may want to consider a firm who has multiple resources to bring professionals in that can help from all angles.

By clarifying your financial goals and needs, you’re setting the stage to finding a financial advisor or financial planner who’s not just competent, but perfectly aligned with your financial journey.

***Speaking of long term goals, what does Retirement look like for you? Click Here to take our short quiz to gain some insights! Or read this articles about retirement designed to be simplistic and though provoking: Eight Mistakes That Can Upend Your Retirement and Does Your Portfolio Fit Your Retirement Lifestyle?

Step 2: Explore the Spectrum of Financial Advisors in Columbus, Ohio and Beyond

Understand the diverse landscape of financial advisory services available:

- Fiduciary Advisors: Ensure your interests are the top priority with advisors who adhere to the fiduciary standard. In case you didn’t know, a fiduciary is a person or organization that is entrusted to manage assets or wealth on behalf of someone else and is required to act in the best interests of that person. This means they must prioritize their client’s needs above their own, avoiding conflicts of interest. They have to submit anything they do to a compliance team for approval.

- Robo-Advisors: Can be ideal for straightforward investing needs, offering low-cost, technology-driven advice. If your not into working with a physical person, maybe this is an option for you!

- Online Financial Advisors: Combine the convenience of digital access with comprehensive advisory services. In todays world you can hop on a video call with anyone anywhere, just be careful that you can vet whoever you choose to work with in a world full of scams.

- Traditional Financial Advisors: Perfect for those seeking in-person guidance and a holistic approach to financial planning. Usually these guys will have a local office and presence, can be fiduciaries as well and meet online. This is your typical advisor.

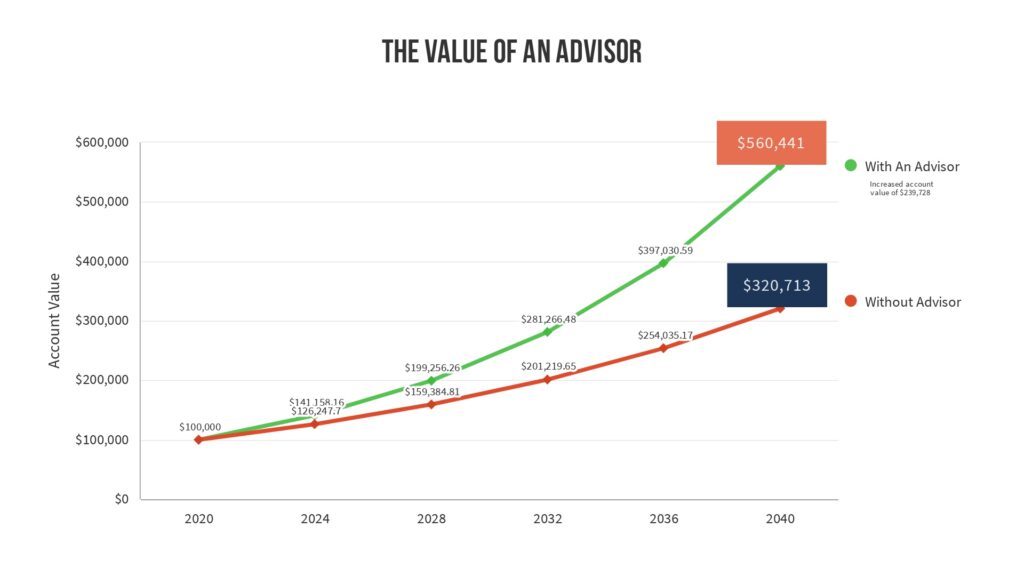

Disclaimer: The investment growth illustrations provided herein are hypothetical and intended for informational purposes only. They are not intended to represent specific investment advice or a guarantee of future results. Actual investment returns can vary significantly due to factors such as market volatility, investment strategy, and economic conditions.

Investment Scenario Explanation:

- Starting Investment: The calculations begin with an initial investment of $100,000.

- Return Rate: An average annual return rate of 6% without a financial advisor and an additional 3% return with a financial advisor is assumed in the illustrations.

- No Additional Contributions: The scenarios assume that no additional contributions are made to the initial investment.

- Time Frame: The investment growth is illustrated over a 20-year period with evaluations every four years.

- Source Credit: The information is based on insights from Fran Kinniry, head of the Vanguard Investment Advisory Research Center, as reported by Barron’s Advisor. For further details, refer to the article: Vanguard’s Fran Kinniry on the Value of Financial Advisors.

Step 3: Delve into Fee Structures

Gain clarity on how advisors are compensated to make informed decisions:

- Fee-Only: Advisors are compensated solely through client fees, avoiding potential conflicts of interest. Usually best for individuals with a very high net worth. For example if an advisor charges 1% to manage fees, the client has $5 Million that’s $50k in fees each year. Often times it makes more sense to pay a flat fee of $15k. On the other end someone who has $500k does not want to fork over $15k for a flat fee, so they opt in for $5,000/year with the 1% fee.

- Fee-Based: A combination of client fees and commissions from financial products they may sell. For example an annuity or insurance product may have fee based options to compensate the advisor. Always ask so you can be clear what’s happening with your money.

- Percentage of Assets: Commonly used by traditional advisors, where fees are a percentage of the assets under management. Using the same example as above an advisor may charge a 1% fee on $500k. Try to avoid cumulative fees of over 1.25%. This includes your management fee plus cost ratio. You would be shocked how easily these can be hidden within your 401k plans and IRA’s. The important takeaway is if your paying a fee you should be getting something for it, like planning services. But your fees shouldnt be destroying your retirement funds.

- Commission: Compensation is made off products sold. This could be something like mutual funds or CD’s. Even insurance products can be tied to a commission, again just ask your advisor to be clear with you and do the research to see if your paying too much.

Step 4: Emphasize Columbus’s Economic Nuances

Select an advisor who is not just a financial planner, but also deeply understands the cities unique economic landscape, including industry trends, local tax implications, and investment opportunities within our dynamic city.

***Why wait? Book a Consultation with us now!***

Understanding the Local Landscape: Why A Local Understanding Matters

In the ever-evolving economic environment of Columbus, Ohio, selecting a financial advisor is a decision that extends beyond mere qualifications and fees. It’s about choosing a partner who possesses an intimate understanding of the local economic landscape and the unique financial opportunities and challenges that come with it. At Reignmakers Wealth Advisors, we pride ourselves on offering not just financial services but localized solutions that are deeply rooted in our understanding of the community and the broader Ohio economy.

Our approach is informed by a deep connection to the community. Many of our advisors and partners are not just financial professionals; they are local business owners themselves, from learning centers and gyms to coffee shops and mortgage officers. This diverse business involvement provides us with a nuanced understanding of the local market, from the perspective of business operations to the broader economic factors that influence success.

This local understanding is particularly vital in light of recent developments, such as Intel’s announcement of a $20 billion chip plant in the area. This monumental investment is poised to reshape the economic landscape of our region, bringing new opportunities and challenges for local businesses and individuals alike. The construction and eventual operation of this facility signify a significant shift in the local economy, with potential impacts on everything from employment to local business growth and real estate values.

For business owners, understanding the ripple effects of such a development is crucial. It can influence decisions ranging from investment strategies to hiring and expansion plans. At Reignmakers Wealth Advisors, we are poised to interpret these changes, providing our clients with insights and strategies that leverage the new economic dynamics brought by Intel’s investment.

Our knowledge extends to navigating Ohio-specific financial nuances, from tax implications to regulatory considerations. With a team that’s not just well-versed in finance but also deeply integrated into the local business ecosystem, Reignmakers offers a unique perspective that aligns with the aspirations and challenges of Columbus residents and business owners.

By choosing Reignmakers, you’re partnering with advisors who not only understand the global financial landscape but also have their fingers on the pulse of local developments. Whether it’s leveraging new opportunities brought by industry giants like Intel or navigating the day-to-day challenges of local business ownership, Reignmakers Wealth Advisors is your partner in crafting a financial strategy that’s as local as it is global.

Key Qualities of Reignmakers Wealth Advisors: Your Experienced Wealth Management Firm In Columbus, Ohio

Personalized Financial Strategy

At Reignmakers Wealth Advisors, we understand that financial planning is not one-size-fits-all. Our approach is deeply personalized, taking into consideration your unique financial situation, goals, and aspirations. Whether you’re a business owner in need of comprehensive asset management or an individual seeking guidance on retirement planning, our advisors tailor their plan to your specific needs, ensuring that your financial plan resonates with your personal and professional objectives. We have assembled a team of CPAs, actuaries, underwriters, attorneys, home and auto insurers and more. We believe an advisor should help you plan for every facet of life, and have put a team together to make sure that’s true.

Fee Transparency

Trust and transparency are the bedrock of our relationship with clients. We believe in full transparency when it comes to fees, ensuring that you understand exactly what you’re paying for and why. Our fee structures are straightforward, avoiding any hidden charges or surprises, allowing you to value the services you receive and make informed decisions about your financial future. In fact, the options will be laid out for you and then you can choose what best fist your circumstances. At the end of the day it just matters what it is you want out of the relationship, this determines what you will spend and if your happy with it we can move forward, if not that’s ok too. We recognize that we are not a good fit for everyone. Typically we can both identify this within the first meeting.

Holistic Financial Services

Our suite of services extends beyond traditional financial planning and investment management. We offer holistic financial solutions that encompass every aspect of your financial life, including retirement planning, tax strategies, estate planning, and more. Our goal is to provide a one-stop solution for all your financial needs, ensuring a cohesive and integrated approach to managing your wealth. This goes back to our diverse team of professionals , whether you are a young family starting out or a multi-million dollar investor/business owner looking to save on taxes we have you covered.

Understanding of Local and Ohio-Specific Financial Strategies

Our deep understanding of the local financial landscape sets us apart. From local tax implications to state-specific investment opportunities, our advisors bring a wealth of local knowledge that can significantly impact your financial strategy’s effectiveness. We stay abreast of local economic developments, like the recent Intel chip plant announcement, ensuring our strategies are aligned with the local economic pulse and leverage opportunities unique to our region.

Fiduciary Standard

As fiduciaries, we are legally and ethically bound to put your best interests first. This commitment to the fiduciary standard ensures that our advice is unbiased, transparent, and tailored to your best interests. Whether we’re crafting your investment portfolio or planning your estate, you can trust that your financial well-being is our top priority. In case you missed it before a fiduciary is required to act in the best interests of the client and they must be able to demonstrate that to the regulatory bodies.

No Minimum Requirement

Reflecting our commitment to inclusivity and community service, we welcome clients from all financial backgrounds. Whether you’re just starting on your financial journey or looking to manage substantial assets, our doors are open. We believe everyone deserves access to top-notch financial advice, and our no-minimum policy ensures that our advisors are accessible to all who seek it.

Community-Centric Approach

Our roots go beyond business. We’re your neighbors, engaged in the same community, and invested in its prosperity. Our involvement in local education, charities, and business networks underscores our commitment to the communities growth and well-being. By choosing Reignmakers, you’re partnering with advisors who not only understand your financial goals but also share your commitment to the community’s future.

Educational Engagement and Empowerment

Understanding the power of knowledge, Reignmakers Wealth Advisors takes a proactive approach to education, offering free seminars that address critical financial topics relevant to the Columbus community. These seminars, including discussions on the upcoming changes in the 2026 estate tax laws and insightful college planning sessions, are designed to empower individuals with the information they need to make informed decisions. By demystifying complex financial subjects, Reignmakers helps build a more financially literate community, fostering confidence and clarity in financial decision-making.

***Got an old 401k? Consider a rollover to possibly avoid excess fees, for a free evaluation of what your paying in fees and to see if we can save you money Click Here to book an appointment. Here are a couple short sweet articles that could help: Navigating Your Wealth: Insights from a 401k Financial Advisor or The Role of a 401k Financial Advisor***

Charitable Involvement and Community Support

Reignmakers’ dedication to Columbus extends to heartfelt participation in charity organizations like Folds of Honor and Relationships Under Construction, reflecting their commitment to giving back and supporting various facets of the community. These partnerships underscore a deep-seated belief in contributing to the city’s welfare and supporting initiatives that align with their values, particularly in education, family, and honoring those who serve.

Networking and Leadership Connections

As active members of the Columbus Chamber of Commerce, Reignmakers Wealth Advisors are at the heart of the city’s business and economic conversations. Their involvement allows them to stay connected with local business trends, share insights, and foster relationships that benefit the broader community. Networking with community leaders, particularly within the Christian community, Reignmakers ensures that their contributions are aligned with the city’s needs and values, reinforcing their role as financial advisors and community pillars.

A Partner in Columbus’s Growth

Reignmakers Wealth Advisors is deeply invested in the success and prosperity of the area. They are more than just a wealth advisory firm in Columbus, Ohio; they are neighbors committed to the collective well-being and future of the city. Their actions, from educational initiatives to charitable contributions and community networking, demonstrate a genuine dedication to Columbus’s growth and the enrichment of its residents.

In a city that thrives on collaboration and community spirit, Reignmakers stands out as a beacon of support, guidance, and engagement, embodying the true essence of being a valuable and integral part of Columbus.

The Reignmakers Difference: Local Knowledge Meets Personalized Strategy

Local Insights for Tailored Strategies

In Columbus’s vibrant economic scene, it’s crucial to have an advisor who’s not just versed in finance but also deeply integrated into our local context. Reignmakers Wealth Advisors stands out by leveraging comprehensive knowledge of Columbus’s industries, growth trends, and Ohio-specific financial intricacies to offer strategies that resonate with your personal and local aspirations.

Your Journey with an Experienced Partner

At Reignmakers, the journey is as important as the destination. By choosing us, you’re not just getting a financial advisor; you’re partnering with a team that’s committed to your growth, adapting strategies as your life evolves—from building wealth to planning your legacy.

Ready to Embark on a Financial Journey Tailored to Your Needs?

Experience a personalized financial journey with Reignmakers Wealth Advisors. Whether you’re exploring financial planning for the first time or seeking sophisticated strategies for wealth management, Reignmakers is equipped to guide you at every step. Contact us for a personalized consultation and start a partnership that respects your interests, addresses your financial goals, and enriches your life in Columbus.